As some of you know, I decided to try out Peer to Peer lending with lending club last year. For those that are unfamiliar with the service, it basically acts as a “bank” with you being the funder. They pass on higher returns to you, and they pass on interest rates that are lower than what the credit card companies offer to the borrower.

Well, a lot has happened since my last update. I was chugging along at a nice clip above 11% last time I checked in, but it seems like I’ve had a few things go sideways on me since then. I’ve had 2 notes default, once of which was rated A3, and the other which was rated C3. The person with the A note seems to have something go seriously sideways. The C3 note made just 1 payment to lending club and then never paid again. Not too sure what happened with those people either. So, after an initial investment of $1000, I’ll never get back about 46.98, which will seriously put a dent in my returns. Other than those two defaults, I have 1 note that is 15-30 days late, and I dont know what the story will end up being with that either. The two that defaulted had been in the second round of investments (the A grade one) and the other one was in the third round of investments (the C grade one).

Thankfully, that’s all with the bad news. I’ve had 3 borrowers pay off their notes in full already. I’m glad to have the money back, but I didnt get the interest that I was expecting out of the group, so that’s unfortunate. I got a total of $4.26 out of the three of those notes, instead of the full year of interest. Perhaps they started reading my website, and decided to get rid of their debt? (Yea, I didnt think so either). Either way, they have paid their loan, and I’ve reinvested the money into other notes.

What was the craziest thing was how far the ROI went down (~66%) after 1% of my notes defaulted). It seemed like as I began to take on more risk, I started getting hit with defaults, though one of the defaults was an A grade note that was using it for real estate investing purposes.

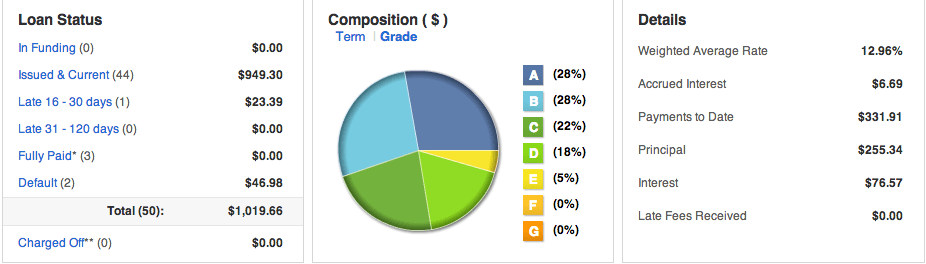

These defaults were bound to happen, and I’m pretty shocked that I was able to go this far without having one to be honest. It is disappointing to watch my return rate get nailed like that, but it’s still chugging along at a greater rate of return than a regular savings account, though I am taking on a bit more risk. Below are the details of my portfolio:

As you can see, over 50% of my risk is in the A and B grade notes, and when you add in the C grade notes, that percentage goes up to 78% of my total money invested. While I havent had my D, E & F grade notes for very long, none of them have defaulted at the current moment. Now that you know how my risk is spread out, lets look at my total stats. Like I mentioned in the earlier posts, I invested $1,000 over three different time periods. My first investment was 300, my next was a few weeks later for 300 again, and my last was a couple months after the first, for 400 to even out my total investment at 1,000. Each of the investment groupings are broken down into their own portfolios via lending club, plus an additional portfolio for the principal and interest payments that come in every month. Here’s where my account is at.

Im a little skeptical of the Net annualized return, because earlier this week it was above 10%, so I’m not sure what the deal is at the moment and why its so low. Perhaps they didnt count the defaults when I last logged in. The portfolio generates about $32 per month in principal and interest repayments, and when I get those payments back, I invest in more notes and place them in a different portfolio like I mentioned earlier. At the beginning I was fairly conservative, investing in mostly A and B notes, an taking on a few C and D grade notes just to balance it out. The portfolio that is made up of exclusively loans that were principal and interest payments took on significantly more risk, as I was feeling more comfortable with the platform and the returns that I was making over the term and was looking forward to juicing up my returns.

As I’m looking at everything right now though, it may be time to get more conservative with my lending with the next few batches of notes. While 4.17% is a good return, I feel like I’m taking on more risk than 4.17% worth. Had I tossed all of this in a S&P 500 index tracker for the last 12 months, my return would have been in the 13% area, so clearly I would have been better off there (and even more so because had I timed the purchases the same, I would have done a significant amount of buying during the low period in july 2012). While I obviously didnt expect to make a huge return off of this little play investment, I dont really want it to lose money either. Obviously, I understood that I was taking on risk, but I thought that I was diversified enough for it not to really affect my total rate of return all that much.

A few days after the writing this post, it looked like this was a low in the ROI, and it looks like my return is starting to creep back up. I’m curious to see what it does in the next couple months, but since everything now is current on my account, my ROI should start to creep back up. While this isnt going as swimmingly as I’d hoped, there’s no QE on personal loans from the fed, so a little downturn is expected. I’ll see what happens with the rate in the future.

Readers: Do you use lending club or prosper? If so, have you caught a handful of defaults that thorpedoed your ROI like I did? What did you do about it?

The annualized return can drop quick with a default. Maybe it was just “late” before and had not been re-categorized?

I have been using Lending Club and Prosper for years (LC longer) and spend a lot of time on each loan. I have never had a default and have an annualized return over 11%.

that’s a pretty good track record eric! One of the ones that defaulted was a bit riskier than my overall portfolio, but the other was an A grade as I mentioned – still kinda shocked this person defaulted, based on the LC rating.

I am at 10.98% (after a year and a half +), it sounds like you’ve been really conservative with this. Why not get more aggressive and pick some low grade loans that have higher interest rates?

I have quite a few lower grade loans, but some of my less risky defaulted. I’m going to let it ride for a bit and see what happens to the ROI – it should tick up a bit.

I just shut down my prosper account after 6 years (last 3 were dormant):

https://www.myjourneytomillions.com/articles/taking-a-look-at-actual-prosper-returns-over-6-years/

My return over those 6 years (again, 3 were completely dormant) was 4.32% Not too bad!

not bad at all evan, I’d be happy with 4% over a few years after the way interest rates have been lately

My ROI at Prosper is about 9%. It was 12% earlier and dropped after a bunch of defaults hit. I’m hoping to hit 10% in the long term.

You probably need to invest in more loans to normalize the defaults. You’ll see more defaults, but it will be closer to the expected rate.

I think that may be a good idea. I’ll have to look at that in the future.

Nice work Jeff! I think diversification is one of your biggest challenges right now. With only $1,000 of investment losing that $46 is quite costly! Stick with it and keep researching viable filters and ways to improve your note selection! Best of luck and I look forward to seeing your continued updates and returns!

I agree. Looking to get a bit more funding in there!